are full dental implants tax deductible

2019 - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. Can I deduct the cost of my all on 4 dental implants Accountants Assistant.

What Dental Work Is Tax Deductible

Please tell me more so we can help you best.

. Dental implants are tax-deductible meaning the IRS might offer significant discounts to seniors on Medicare with extensive physical and oral health expenses. The Accountant will know how to help. There is a small catch though.

Dental implants are tax-deductible meaning the IRS might offer significant discounts to seniors on Medicare with extensive physical and oral health expenses. Dental implants are tax-deductible meaning the IRS might offer significant discounts to seniors on Medicare with extensive physical and oral health expenses. The good news is that will include all of your medical and dental expenses not just your dental implants.

Key points to remember. To help you with this cost the Canada Revenue Agency allows dental expenses to be used as medical expense deductions when you file your income tax. On the other hand teeth whitening is considered cosmetic and not deductible.

This includes fillings dentures implants. While dental implants arent specifically mentioned in IRSPublication 502 the IRS says. English If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct expenses you paid that year for medical and dental.

That said you can deduct only the portion of your expenses that exceed 75 of your. Dental expenses includes fillings. Only the expense that you paid with out of pocket funds is deductible.

The good news is yes dental implants are tax deductible. Remember though that your itemized deductions for medical dental. Most dental expenses can be used as medical expense deductions when filing your income taxes in Canada including.

Are full moth dental implants tax deductible on Schedule A. Yes if they are not merely cosmetic and the dentist has recommended them as treatment for your dental condition. You can include in medical expenses the amounts youpay for the prevention and.

This is good news for people who are considering implants and dont have. Denture implants and dental implants are eligible medical expenses that you can claim on your tax return. Dental and medical insurance premiums are tax-deductible on Form 1040 Schedule A.

Yes the dental implant is a medical expense deductible as an itemized deduction on Schedule A. Dentures and dental implants are also tax deductible with the IRS and included in the non-preventive category but elective cosmetic procedures such as teeth whitening and. Dental insurance for purely cosmetic purposes such as teeth whitening or cosmetic implants would not be deductible.

You can only deduct expenses greater than 75 of.

Is Cosmetic Dentistry Tax Deductible American Cosmetic Dentistry

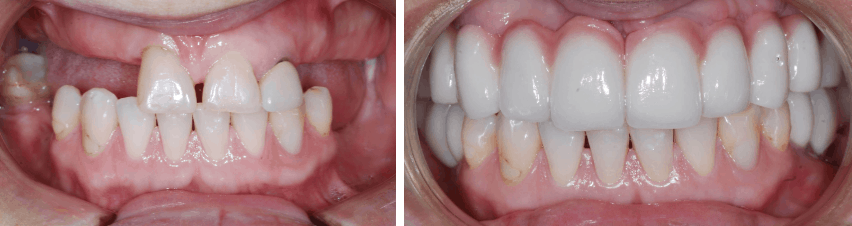

Smile In A Day Procedure All On 4 Treatment Dental Implants

Is A Dental Implant Better Than A Denture News Mydental

Are Dental Implants Tax Deductible Atlanta Dental Implants

12 Easy Ways To Get Affordable Dental Implants In 2022 Authority Dental

Dental Implants Abutments Henry Schein Dental

Dental Implants Faq Vancouver Centre For Cosmetic And Implant Dentistry

Memphis Tn All On 4 Dental Implants Costs Financing Options Payment Plans

Dental Implants For Seniors On Medicare Cut Costs 9 Ways

Is Invisalign Tax Deductible Dr Hall Media Center

Huntington Beach Ca Full Mouth Dental Implants Cost Financing Harbor Smiles

Can You Deduct The Cost Of Dental Care In Costa Rica On Your Taxes

Are Dentures Dental Implants Tax Deductible Calgary Dentures

Dental Implants Vs Dentures Which One Is Right For You Blog Philippine Dental Implants

3 Irs Dental Implant Discount Plans Tax Deductible Savings

Are Dental Expenses Tax Deductible Dental Health Society

3 In House Financing For Dental Implants Grants For Medical

Dental Implants Cost In Palos Verdes And South Bay California